Portfolio Comparison: January 2012

February 5, 2012 2 Comments

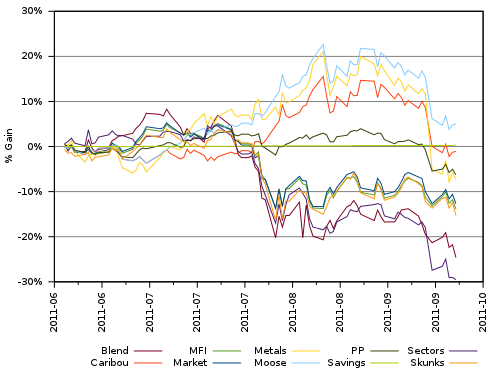

January was a great month for stocks. It feels good to say that, as it hasn’t been an incredibly common sentiment in recent months. In this monthly comparison, however, we still don’t even have a single year’s worth of data, so drawing any conclusions is a little premature. Still, there are some interesting things to note, so let’s start by looking at the data:

| Portfolio | Last Month | This Month | % Chg | Total Gain | CAGR |

|---|---|---|---|---|---|

| Decision Moose | $105276.92 | $105267.37 | -0.009% | +$5267.37 | +8.161% |

| Magic Formula | $94968.53 | $103262.72 | +8.734% | +$3262.72 | +5.029% |

| U.S. Market | $97637.07 | $102586.05 | +5.069% | +$2586.05 | +3.979% |

| Permanent Portfolio | $95535.20 | $102129.42 | +6.902% | +$2129.42 | +3.272% |

| Caribou | $101948.78 | $101612.45 | -0.330% | +$1612.45 | +2.475% |

| Precious Metals | $87913.07 | $101552.96 | +15.515% | +$1552.96 | +2.383% |

| Savings Account | $100544.85 | $100613.41 | +0.068% | +$613.41 | +0.939% |

| Skunks of the Dow | $88038.80 | $99865.19 | +13.433% | -$134.81 | -0.206% |

| Mechanical Blend | $84344.78 | $87103.61 | +3.271% | -$12896.39 | -19.023% |

| Sector Flow | $76669.31 | $80734.64 | +5.302% | -$19265.36 | -27.895% |

There were only two failures in January: Decision Moose and Caribou. Since they were both invested in bonds for the month, we can draw the conclusion that bonds were not the place to be. Since I believe both portfolios were in TLT for the entire month, I initially had no idea why they didn’t have the same percentage gain. After doing some research, however, it looks like Decision Moose benefited from the receipt of a dividend early in the month that Caribou missed. So, with our failures out of the way, let’s talk about what did work.

Making tremendous gains this month was the Precious Metals portfolio, which recouped December’s losses and then some. Of course, this still only averages out to a paltry CAGR of 2.3%, but I suppose it’s better than nothing. More important, there are only two non-savings account portfolios which aren’t beating this important benchmark.

The rest of the portfolios all had varying gains from good to fantastic. It was a good month for stocks overall, and in the end, it came down to little more than holding the right stocks. Most portfolios are now above zero or at least close to it. The two remaining stragglers are the Mechanical Blend and Sector Flow portfolios. As we’ve seen, however, things can change in an instant, so don’t count either of these two portfolios out. (I still consider them two of the most likely portfolios to be on top after several years.)

For a slight change of pace, I’m actually making this post in advance of the rebalancing date, which is Monday, February 6. Changes this month are few and far in between, but the Magic Formula portfolio will be adding PERI and TNAV. The Mechanical Blend portfolio will shift around as usual, of course. The rest of the portfolios will be merely rebalancing. (This monthly update kind of masks the fact that Decision Moose, Caribou, and Sector Flow can signal changes every week.)

Disclaimer: This post is a description of my own forays into investing, offered as general market commentary, and should not be construed as investment advice or the recommendation of a particular security over any other.