Portfolio Comparison: April 2011

April 29, 2011 Leave a comment

It’s been a long time, but lo and behold as The Confused Investor returns after almost a year of inactivity. In that time, I’ve aged another year, moved across the country and, of course, learned a lot more about the financial world. Speaking of the financial world, it wasn’t a slouch either, as far as changes go. The summer of 2010 was a tough time to be invested in stocks, with most portfolios going nowhere fast. Once September came around, however, the bull firmly took back control of the reigns, and the market’s continued to move upward since.

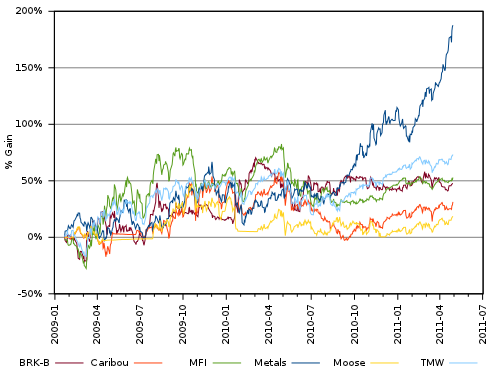

Of course, it’s not been all roses with all of the portfolios in this portfolio comparison. While it’s true that I haven’t posted in almost a year, I have nonetheless continued to track the portfolios, with one notable exception: the Magic Formula portfolio. Being the one portfolio in the comparison I had invested real money in, it underwent some changes to better fit my overall investment allocation strategy once I was no longer maintaining this blog. Money was added and removed, and I temporarily switched to a momentum-based monthly rebalancing strategy (which I’ve subsequently scrapped). So, while its total value is no longer comparable to the others, I can report some basic statistics about its performance. Here are the table and chart you’ve all come to know and love, showing the results for the past year:

| Portfolio | Last Year | This Year | % Chg | Total Gain | CAGR |

|---|---|---|---|---|---|

| Precious Metals | $2233.53 | $4146.14 | +85.63% | +$2346.14 | +59.382% |

| TMW | $2357.92 | $2771.51 | +17.54% | +$971.51 | +27.432% |

| Magic Formula | $2573.13 | N/A | -15.59% | N/A | +20.597% |

| Berkshire Hathaway | $2257.22 | $2441.90 | +8.18% | +$641.90 | +18.719% |

| Caribou | $2299.83 | $2227.92 | -3.13% | +$427.92 | +12.766% |

| Decision Moose | $1990.21 | $2056.47 | +3.33% | +$256.47 | +7.801% |

The most important point to make is that nothing beat the two benchmark portfolios (TMW and the precious metals). Doing nothing more than buying and holding a broad-market index fund is looking excellent right about now. Of course, that could all change the next time we find ourselves in a bear market. In any case, let’s briefly discuss what each portfolio did over the last year:

- The precious metals are currently in first place, and it’s not even close. As you may or may not recall, this portfolio is based on my precious metals index, which consists of roughly equal investments in both gold and silver, rebalanced every so often. Gold has done very well over the past year, finding itself up over 33%. Of course, this is chump change compared to silver, which is up 158% over the same one-year period. With results like these, it’s no wonder that there is ample discussion about a potential bubble in silver. I’m not going to make a prediction either way, but if you listen to the abundant prognosticators out there, silver (which is currently at $47.94 per ounce) could end up anywhere from $10 per ounce to $1000 per ounce over the next year. It’s nothing if not exciting, I suppose. The current results don’t make me feel very good about the U.S. dollar, in any case.

- Compared to the precious metals, everything else looks like a big loss, but the overall market, as represented by TMW, was nonetheless up 17% in the past year. Sure, it’s not 158%, but it sure beats my savings account.

- Next, we have the Magic Formula portfolio. While it’s difficult to analyze this one in any real detail, it’s apparent that it had a tough year. Its worst time was in the aforementioned summer of 2010, where it lost quite a bit of value. It’s slowly been on the rise since then, however. Nonetheless, an estimated loss of 15% is a tough pill to swallow.

- Berkshire Hathaway had a decent year, but it didn’t come close to matching the overall market. Strangely, it’s really gone nowhere since last September, with BRK-B trading in a range of $80-$85 for the most part.

- The Caribou model was unimpressive in the past year, losing a little over 3% of its value. May to September of last year was essentially a smooth ride down, with it unable to regain what it lost so far. However, it has been promising in recent weeks.

- Finally, Decision Moose managed to gain a little over 3%. However, it’s still the worst portfolio in this comparison, and I’m beginning to wonder if the Moose will ever recapture its former glory.

I’m providing this update mainly as a convenience for any readers that have been around for a while. However, this will likely be the last post in this particular portfolio comparison series. The rebalancing strategies for each portfolio were never rigorously defined, and I’ve made a complete mess of the Magic Formula portfolio. As such, I’m much more likely to start anew with a fresh set of portfolios. I probably have about ten to twenty potential candidates for inclusion, so it’ll really come down to choosing which ones to include and which to leave on the bookshelf. I’ll try to do that in the next few days, as opposed to disappearing for another year.

Disclaimer: This post is a description of my own forays into investing, offered as general market commentary, and should not be construed as investment advice or the recommendation of a particular security over any other.